Introduction

When people search for BTC CoinGecko, they are usually looking for a reliable and real-time overview of Bitcoin’s performance. CoinGecko has become one of the most trusted platforms for cryptocurrency data, offering not just Bitcoin prices but a comprehensive set of metrics that help investors, traders, and researchers understand the market. Unlike a single-exchange chart, CoinGecko aggregates information from hundreds of trading platforms, ensuring that the Bitcoin (BTC) price shown is a fair, volume-weighted global average.

In this article, we will explore in detail how CoinGecko tracks Bitcoin’s market data, what features are available on its BTC page, how to interpret the numbers, and why so many people rely on it as their go-to crypto data source. We will also compare CoinGecko to other well-known platforms, and highlight the benefits of using it for Bitcoin price insights.

How CoinGecko Tracks Bitcoin Price

BTC CoinGecko calculates the live Bitcoin price by pulling data from hundreds of exchanges and thousands of trading pairs. Instead of relying on just one exchange, it uses a volume-weighted average price (VWAP) formula. This means that larger markets with higher trading activity have more influence on the final displayed price than illiquid or small exchanges.

For example:

- If Bitcoin trades at $111,000 on a major exchange with billions in volume, and at $115,000 on a small exchange with very little trading, CoinGecko will give more weight to the $111,000 price.

- The result is a global Bitcoin price that better reflects reality and avoids manipulation by illiquid markets.

This methodology ensures that the Bitcoin price shown on CoinGecko is more accurate, reliable, and resistant to outliers than simply taking a single exchange’s number.

Features of the BTC Page on CoinGecko

The Bitcoin (BTC) page on CoinGecko includes a wide range of features designed to provide a full picture of the market:

- Live Price and Currency Conversion: Bitcoin’s real-time price in multiple fiat currencies (USD, EUR, GBP, JPY, SEK, etc.) and stablecoins.

- Interactive Chart: Adjustable timeframes (1h, 24h, 7d, 1m, 3m, 1y, YTD, All Time). Users can choose line or candlestick charts, compare BTC to other coins, and overlay market capitalization.

- Market Data Summary: Key figures such as Market Cap, Circulating Supply, Total Supply, Max Supply, Trading Volume, and Fully Diluted Valuation.

- All-Time High and Low: Historical benchmarks showing Bitcoin’s peak and lowest recorded prices.

- Historical Data Table: Downloadable daily price, volume, and market cap history.

- Community and Development Stats: GitHub commits, Twitter/X followers, Reddit activity, and developer contributions.

- News and Events: Aggregated headlines and upcoming Bitcoin-related events.

- Portfolio and Watchlist Tools: Users can add BTC to a personalized watchlist or portfolio to track gains and losses.

Table: Key Bitcoin Market Metrics on CoinGecko

| Metric | Example Value (for illustration) | Explanation |

|---|---|---|

| Price (USD) | $112,000 | Current price of one BTC, calculated using global VWAP. |

| Market Capitalization | $2.24 trillion | Price × circulating supply. |

| 24h Trading Volume | $32 billion | Sum of all BTC trades across tracked markets in the last 24 hours. |

| Circulating Supply | 19.9 million BTC | Number of BTC actively circulating in the market. |

| Max Supply | 21 million BTC | Absolute cap coded into Bitcoin’s protocol. |

| Fully Diluted Valuation | $2.47 trillion | Price × max supply, representing total potential market cap. |

| All-Time High (ATH) | $124,128 | Highest recorded BTC price to date. |

| All-Time Low (ATL) | $67 | Lowest recorded BTC price when data tracking began. |

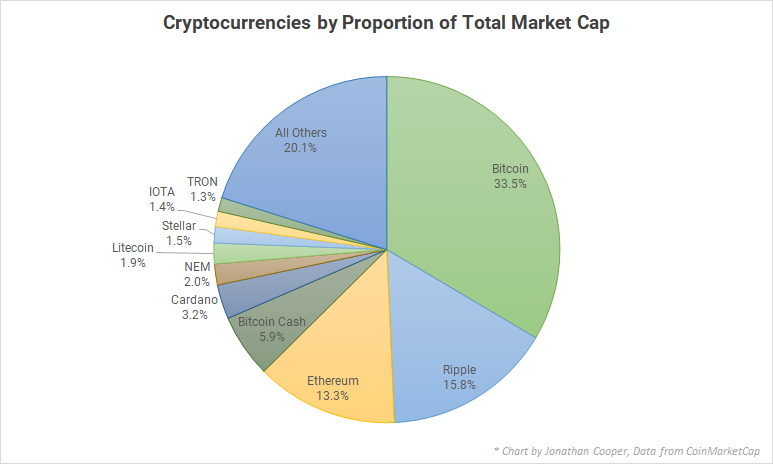

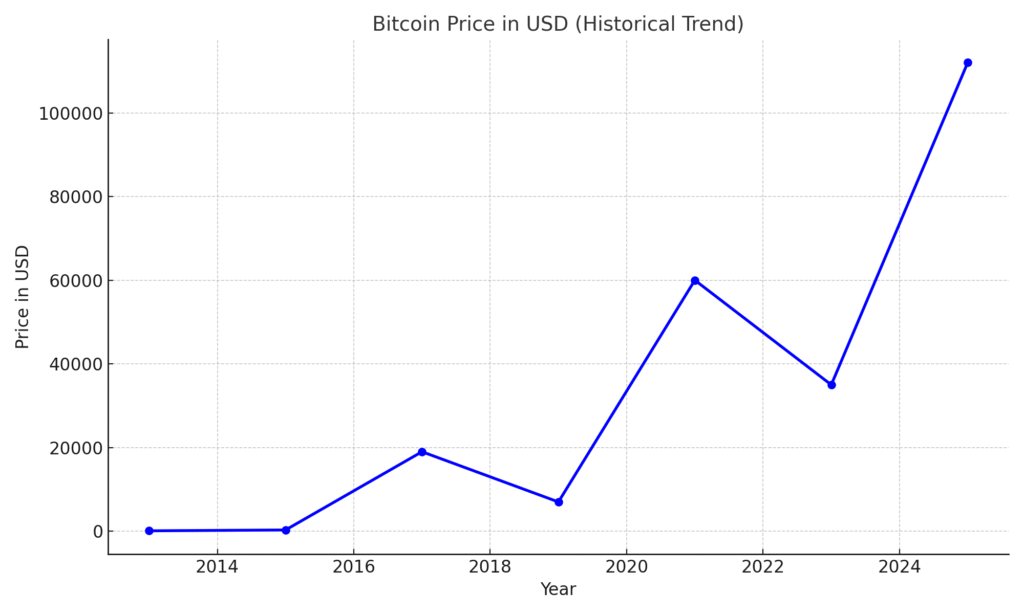

Chart: Bitcoin Price Performance Over Time

(Chart of Bitcoin price from 2013 to present, showing long-term growth and key cycles. Highlight ATH and major corrections.)

This chart demonstrates Bitcoin’s extreme volatility but also its long-term trend of appreciation. CoinGecko allows users to interact with such a chart directly, zooming into shorter periods or comparing Bitcoin against other assets like Ethereum.

How to Interpret CoinGecko’s Bitcoin Data

CoinGecko provides raw numbers, but understanding what they mean is essential:

- Market Cap: Shows the total valuation of Bitcoin in circulation. If market cap rises, it means either the price has increased or more BTC have entered circulation (although supply growth is slow).

- 24h Volume: Indicates liquidity. High trading volume means Bitcoin is being actively traded, which typically reduces volatility and makes price manipulation harder.

- Circulating Supply vs. Max Supply: Helps users understand Bitcoin’s scarcity. With ~19.9 million BTC already mined and a max supply of 21 million, Bitcoin is nearly fully issued.

- All-Time High/Low: Useful benchmarks for assessing how far current prices are from historical extremes.

- Fully Diluted Valuation (FDV): Shows what Bitcoin’s market cap would be if all 21 million BTC were in circulation. It’s especially relevant for altcoins with large unissued supplies, but in Bitcoin’s case, FDV is nearly equal to market cap.

Why Use BTC CoinGecko?

There are several reasons why investors and enthusiasts trust CoinGecko for Bitcoin data:

- Independence: Unlike some competitors, CoinGecko is not owned by a major exchange, reducing potential conflicts of interest.

- Transparency: Clear definitions of each metric and an open methodology for price calculation.

- Breadth of Data: Beyond price, CoinGecko includes developer activity, community growth, and even DeFi-related data.

- Free and Accessible: All essential features are free to use, with APIs available for developers.

- Multi-Currency Support: Easy to view Bitcoin’s price in dozens of local currencies.

- Educational Value: Explanations alongside metrics make it beginner-friendly while still useful for advanced users.

Comparison: CoinGecko vs. Other Platforms

While CoinGecko is highly popular, it’s worth comparing it to other Bitcoin data providers:

- CoinMarketCap (CMC): Similar in scope, but owned by Binance. Some users prefer CoinGecko for independence. Both platforms aggregate data, but CoinGecko often lists more tokens and exchanges.

- TradingView: Best known for advanced charting tools, not as much for aggregated prices. Many traders use BTC CoinGecko for price reference and TradingView for technical analysis.

- Investing.com / Yahoo Finance: Good for financial context and news, but less crypto-native than CoinGecko.

- Exchange Websites (Binance, Coinbase, Kraken): Provide accurate prices, but only from their own markets, which may differ from global averages.

Summary

Searching for BTC CoinGecko usually means you want a clear and accurate view of Bitcoin’s market situation. CoinGecko delivers this by aggregating real-time data from hundreds of exchanges and presenting it in an intuitive, educational format. Whether you are a beginner curious about Bitcoin’s price or an experienced trader monitoring market cap and liquidity, BTC CoinGecko provides the tools you need. Its combination of live charts, historical data, community metrics, and independent methodology makes it one of the most valuable resources in the cryptocurrency ecosystem.

Also read “When to Buy Crypto?”: https://cryptoidolo.com/when-to-buy-bitcoin/

References

- CoinGecko – Bitcoin (BTC) Price and Market Data: https://www.coingecko.com/en/coins/bitcoin

- CoinGecko Blog – Methodology and Definitions: https://blog.coingecko.com

- CoinMarketCap – Bitcoin Price Data: https://coinmarketcap.com/currencies/bitcoin

- TradingView – Bitcoin (BTCUSD) Charts and Stats: https://www.tradingview.com/symbols/BTCUSD

- Investing.com – Bitcoin Live Chart: https://www.investing.com/crypto/bitcoin/btc-usd