Hello, genius crypto degen! Are you still paying full trading fees? Check out this deal: sign up on MEXC with the referral code mexc-provip (https://www.mexc.com/acquisition/custom-sign-up?shareCode=mexc-provip) and enjoy a permanent 20% discount on your trading fees. Now, let’s dive into today’s top crypto news.

Bitcoin Hits Record High Before Slight Pullback

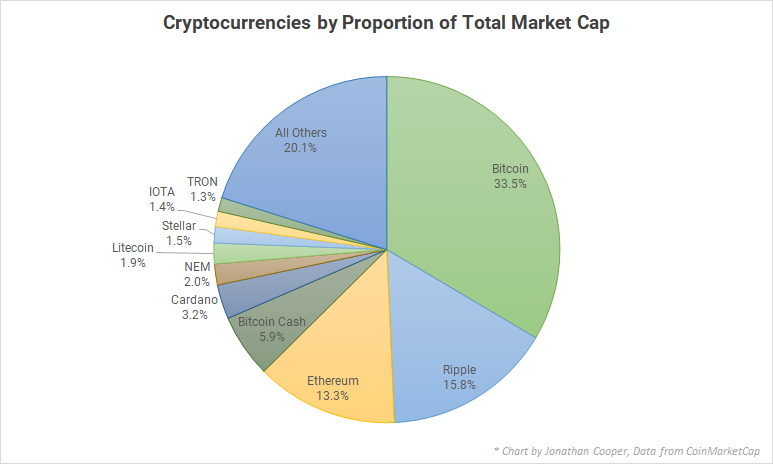

Bitcoin (BTC) reached a new all-time high of around $124,000 this week, briefly surpassing a $2.4 trillion market capitalization – even larger than Google – to become the world’s fifth-largest asset by market cap. The rally was fueled by growing institutional demand and macroeconomic trends, as investors seek hedge against inflation and fiscal uncertainty. Traders celebrated the milestone with classic “to the moon” enthusiasm, but the excitement was tempered by a swift correction. Some technical indicators had begun flashing overbought conditions at those heights, hinting at a short-term top, yet on-chain data showed no definitive signs that the bull run was over (Lubale, 2025).

On Thursday, BTC retraced to about $119,000 after U.S. Treasury Secretary Scott Bessent poured cold water on hopes of further government Bitcoin buys. Bessent confirmed that the government will not make new Bitcoin purchases for its strategic reserve, beyond using already confiscated crypto assets. His remarks came just hours after Bitcoin’s price peak, triggering a sell-off as some traders took profits. “We’re not going to be buying [Bitcoin], but we are going to use confiscated assets and continue to build [the reserve] up,” Bessent told Fox Business.

Despite the pullback, market sentiment remains optimistic. Notably, the U.S. government’s stance on crypto has evolved under recent policy: President Donald Trump established a national Bitcoin reserve earlier this year using seized crypto, signaling a long-term belief in digital assets even if direct purchases are on hold. And in a silver lining, Bessent also assured that the government has no plans to sell its existing Bitcoin holdings, likening a national BTC reserve to a “digital Fort Knox” for value storage. With the U.S. national debt topping $37 trillion, some analysts joke that Uncle Sam might HODL harder than the average crypto degen.

XRP Soars as Ripple’s SEC Saga Nears Conclusion

XRP, the third-largest cryptocurrency, surged past $3 this week amid rising speculation that the U.S. Securities and Exchange Commission (SEC) may finally drop its long-running lawsuit against Ripple Labs. The token jumped over 4% in 24 hours to reclaim the $3.00 level, energizing XRP holders who have endured a rollercoaster legal battle since 2020.

Fueling the optimism was a post by crypto lawyer Bill Morgan, who predicted the SEC would likely dismiss its appeal by the August 15 deadline for the case. Both the SEC and Ripple are due to file a joint status report in court by that date, and many interpret the signs as pointing to a potential settlement or victory for Ripple. “Dismissal of the appeals may happen, and is more likely to happen than not, before the 15 August deadline,” Morgan noted, suggesting the nearly five-year saga could finally conclude.

If the court proceedings indeed wrap up, it would mark the end of one of crypto’s most watched legal dramas. The SEC’s suit, filed in December 2020, alleged Ripple sold XRP as unregistered securities. After partial victories on both sides over the years — including a 2023 ruling that XRP is not a security in retail sales — a final dismissal would remove a dark cloud hanging over XRP. Traders and beginners alike should note that even major legal overhangs can eventually clear, though it often takes patience. With regulatory clarity improving, XRP’s price has responded accordingly, making a strong comeback in the market. Some in the community are already jokingly updating their “When Lambo?” calendars in anticipation.

Altcoins Rally: Chainlink’s Big Win and Meme Coin Mayhem

It’s not just Bitcoin and XRP in the limelight. Altcoins saw action too, led by a standout performance from Chainlink (LINK). The popular blockchain oracle token jumped about 10% in one day and over 40% this week, reaching around $24 – its highest price in seven months. The rally came after Chainlink announced a major partnership with Intercontinental Exchange (ICE) – the parent company of the New York Stock Exchange – to bring real-time finance data on-chain, bridging traditional finance and crypto. Additionally, Chainlink’s team revealed a new “Chainlink Reserve” program that uses protocol revenues to buy back LINK tokens, establishing persistent buying momentum. These developments have excited traders about LINK’s long-term prospects, with technical indicators suggesting the momentum could continue (Sandor, 2025).

Other altcoins also enjoyed gains as overall crypto market capitalization hovered around $3.7 trillion. Even perennial memes got a boost: Dogecoin (DOGE) spiked roughly 8%, proving that the dog-themed coin still has some bite left in market rallies. On the flip side, not every coin had a good week – some lesser-known tokens tanked. For instance, the unfortunately named Fartcoin (FART) suffered a stinky -30% plunge. (Yes, that’s a real coin – welcome to crypto, beginners!) And remember Bonk? That meme coin darling from last cycle dropped about 28%. The wild divergence in altcoin fortunes this week is a reminder to newcomers: crypto markets can swing wildly, and what soars one week could flop the next.

Meanwhile, mainstream adoption news continues to trickle in. A recent Deloitte survey of CFOs at large companies found that 99% of finance chiefs expect to be using crypto for business in the long term, and nearly a quarter plan to have their firms using crypto within two years. Such data points underscore that even as memes moon and bust, big players are quietly preparing for a crypto-integrated future.

Regulators are also staying active. In the United States, the Treasury’s Office of Foreign Assets Control (OFAC) made headlines by sanctioning the crypto exchange Garantex (again) over illicit finance concerns. And across the pond, UK authorities lifted a ban on certain crypto investment products for retail consumers, reflecting a gradual thaw in regulatory attitudes.

Bottom Line: It’s been an eventful couple of days in crypto. Bitcoin is showing its strength against global giants, XRP might finally break free from its legal shackles, and altcoin opportunities (and risks) abound. For beginners, the key takeaway is to stay informed and be prepared for volatility – today’s big winner could be tomorrow’s correction. For veteran traders, it’s just another week in the crypto wild west, navigating news and noise on the way to the next big trade. Happy trading, and don’t forget to snag those trading fee discounts like a true crypto degen!

References (APA 7th ed.)

- Vardai, Z. (2025, August 07). XRP tops $3 as Ripple case nears potential SEC dismissal. Cointelegraph. cointelegraph.comcointelegraph.com

- Vardai, Z. (2025, August 14). Bitcoin drops below $119K after US Treasury secretary rules out new BTC buys. Cointelegraph. cointelegraph.comcointelegraph.com

- Lubale, N. (2025, August 14). Bitcoin’s new record high has traders asking: Did BTC price top at $124K?. Cointelegraph. cointelegraph.com

- Sandor, K. (2025, August 12). LINK surges 10% as Chainlink Reserve, ICE partnership fuel explosive rally. CoinDesk. coindesk.comcoindesk.com

- Lyons, C. (2025, August 03). XRP eyes 20% surge in August, crypto returns to US (Hodler’s Digest). Cointelegraph. cointelegraph.comcointelegraph.com

- Wright, T. (2025, August 15). US Treasury’s OFAC sanctions crypto exchange Garantex for second time. Cointelegraph. cointelegraph.com