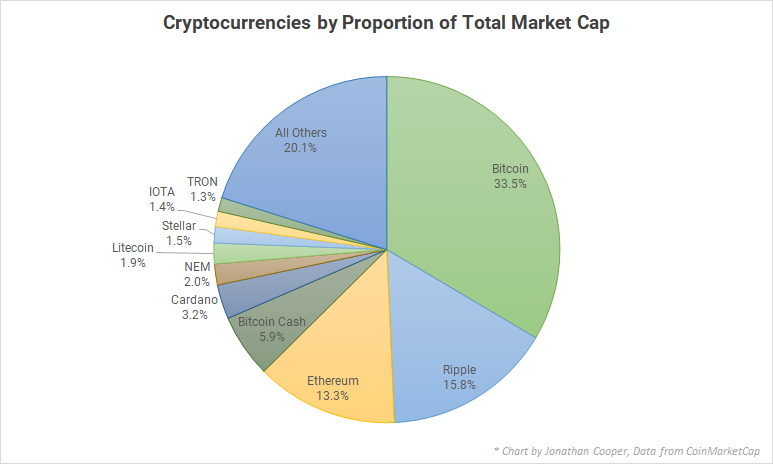

Ethereum (ETH) is the second-largest cryptocurrency and a cornerstone of the DeFi and smart contract ecosystem. Forecasting its future price helps investors evaluate potential returns and manage risk. An Ethereum price prediction 2025 must account for many drivers, including network upgrades (e.g. Ethereum’s full shift to Proof-of-Stake), institutional adoption, regulatory developments, and market sentiment. For example, Bitpanda Academy notes that optimistic forecasts have Ethereum “rising above $5,000” by the end of 2025, while bearish analyses see it possibly falling below $2,000. Given these divergent views, this guide examines key factors and scenarios shaping Ethereum’s price outlook for 2025 (Bitpanda Academy, n.d.; Beddow, 2025; Taylor, 2025).

Key Factors Influencing Ethereum’s Price

Several core factors will drive Ethereum’s USD price through 2025:

- Institutional Adoption: The launch of spot Ethereum ETFs in 2024 makes it easier for institutional investors to buy ETH. Greater liquidity and capital inflows from pension funds or ETFs could push the price higher.

- Network Upgrades: Ethereum’s continued upgrades (such as the Pectra and Dencun upgrades) reduce gas fees and improve scalability. These make the network more attractive for developers and users, potentially boosting demand and price.

- DeFi and dApps Growth: Ethereum remains the leading platform for decentralized finance (DeFi) and NFTs. Expanding use cases and real-world applications can create sustained demand for ETH (Bitpanda Academy, n.d.).

- Competitive Pressure: Competing blockchains (e.g. Solana, Avalanche, Sui) offer faster transactions or lower fees. If competition draws away developers/users, Ethereum’s price could suffer.

- Regulatory Environment: Legal clarity (positive or negative) will sway investor confidence. Stricter regulations could suppress crypto markets, while clear rules (or positive regulatory moves) might encourage investment (Bitpanda Academy, n.d.).

- Macroeconomic & Crypto Cycle: Broader market trends (like interest rates, inflation, crypto bull/bear cycles) heavily influence ETH price. In general, crypto tends to follow Bitcoin’s lead and global risk appetite. Volatile swings in global markets can lead to large ETH price moves, as noted by experts.

Table 1 summarizes some major drivers of the Ethereum price.

| Factor | Potential Impact on ETH Price | Source/Comment |

|---|---|---|

| Spot Ethereum ETFs | ↑ Likely boosts demand via institutional inflows | Approved July 2024 |

| Network Upgrades (Pectra, etc.) | ↑ Improves scalability and use cases | Eases fees, adoption |

| DeFi/NFT & dApps Usage | ↑ Increases ETH usage and demand | Ethereum hosts leading DeFi/NFT activity |

| Competition (Solana, etc.) | ↓ Could divert users/miners if ETH slower/more expensive | Solana, Sui growth cited by analysts |

| Regulatory Clarity | ↕ Depends on policy (friendly vs. strict) | SEC approvals vs. crackdowns |

| Global Market Trends | ↕ Crypto correlates with equity/FX markets | Geopolitics, Fed policy can sway ETH |

(Table 1: Key factors affecting Ethereum’s 2025 USD price.)

Forecast Scenarios for 2025

Analysts offer varied Ethereum price predictions for 2025. To illustrate the range:

- Bullish Scenario: In the most optimistic case, sustained demand and network growth push ETH above its 2021 high (~$4,800). Bitpanda Academy notes that if current trends hold (growth in ETFs and upgrades), Ethereum “will rise above $5,000 by the end of 2025”. Other pundits (e.g. some crypto forecasting models) even see average prices in the $6,000+ range (Changelly’s model predicts ~$6,124 by 2025). If a strong bull market returns (e.g. another crypto cycle peak), targets of $7,000–$10,000 have been speculated in that case.

- Bearish Scenario: Conversely, cautious analysts warn of a pullback. Bitpanda Academy highlights that some see ETH falling back toward ~$2,000 by late 2025 due to competition and regulatory fears. CryptoNews’ analysis (April 2025) places most price targets between $1,500 and $2,500 for 2025. Under this scenario, Ethereum might hover around multi-year lows if broader crypto sentiment sours.

- Neutral Scenario: In a middle path, ETH might trade in a range roughly between $2,000 and $4,000. This assumes bullish drivers (like ETF adoption) roughly balance bearish pressures (competition, regulations), leading to sideways or modest growth. Some analysts anticipate Ethereum staying “within a price range” without breaking major new highs or lows in the short term.

These scenarios underscore how Ethereum price forecasts for 2025 can diverge. No prediction is guaranteed. The wide range from ~$1,500 to over $5,000 reflects differing assumptions about future demand, crypto cycles, and external events.

Ethereum Price Predictions by Source

To visualize the spread of forecasts, Table 2 lists representative 2025 price targets from various analyses and tools:

| Source | 2025 Forecast / Range (USD) | Note/Scenario |

|---|---|---|

| Bitpanda Academy | Above $5,000 (bullish) | Strong inflows + upgrades |

| CryptoNews (Beddow, 2025) | $1,500 – $2,500 | Depends on macro, market momentum |

| Changelly (Taylor, 2025) | ~ $6,124 (average) | 5% annual growth model |

| InvestingHaven (May 2025) | $2,906 – $5,000 (min–max) | (Example range, independent analysis) |

| CoinPedia (2025) | Max $5,925 (bull case) | See their price forecast |

(Table 2: Ethereum price prediction 2025 by various sources. Forecast ranges reflect different bull/bear assumptions.)

These forecasts illustrate that expectations vary widely. In practice, Ethereum’s price will be set by real market trades, so the actual path may differ. Investors should treat such predictions as illustrative scenarios (Bitpanda Academy, n.d.; Beddow, 2025).

Risks and Uncertainties

All forecasts come with caveats for Ethereum price prediction 2025. Key risks and uncertainties include:

- Market Volatility: Crypto markets are extremely volatile. Sudden drops (e.g. due to macro shocks or crypto contagion) can invalidate predictions.

- Regulatory Shocks: Unexpected regulatory changes (like a ban or severe restrictions) could sharply depress ETH’s price.

- Technical Failures: Major bugs or delays in Ethereum upgrades could undermine confidence and price.

- Competition Gains: Rival blockchains attracting more users or developers could erode Ethereum’s dominance, reducing its value.

- Macro Trends: A crypto bear market (e.g. driven by rising interest rates) could keep ETH prices down even if fundamentals improve.

- Speculative Swings: Social media hype or de-risking flows can cause rapid overshoots.

No forecast model can account for all events. As Bitpanda Academy cautions, “forecasts are no guarantee” and should not replace independent analysis. Investors must research and remain prepared for multiple outcomes (Bitpanda Academy, n.d.).

Conclusion: Ethereum Price Prediction 2025

In summary, the Ethereum price prediction 2025 spans a broad spectrum. On one hand, institutional interest and network advances could drive ETH well above its past peaks; on the other hand, competitive and regulatory headwinds might keep it subdued. By some analyses, we may see Ethereum trading in the low thousands of dollars, while others project $5,000+ if bulls dominate.

Ultimately, Ethereum’s future price will reflect the balance of these forces. Readers should interpret forecasts cautiously and follow ongoing developments (e.g. ETF flows, upgrade releases, macro shifts). As always, use price predictions as one input among many when making investment decisions (Bitpanda Academy, n.d.; CryptoNews, 2025; Changelly, 2025).

Also read about When to Buy Bitcoin?: https://cryptoidolo.com/when-to-buy-bitcoin/

References (APA 7th edition):

- Bitpanda Academy. (n.d.). Ethereum forecast 2025: trends, scenarios and expert opinions. Bitpanda Academy. Retrieved from [bitpanda.com]

- Beddow, B. (2025, April 2). Ethereum Price Prediction 2025–2030: Will ETH Bounce Back? CryptoNews. Retrieved from [cryptonews.com]

- Taylor, S. (2025, August 23). Ethereum (ETH) Price Prediction 2025-2040. Changelly. Retrieved from [changelly.com]

- InvestingHaven. (2023). Ethereum (ETH) Price Prediction 2025, 2026, 2027. Retrieved from [investinghaven.com]

- CoinPedia. (2023). Ethereum Price Prediction 2025, 2026 – 2030: Can ETH Reach $10k? Retrieved from [coinpedia.org]

Pingback: Best Crypto to Buy Now – September 2025 - Crypto Idolo