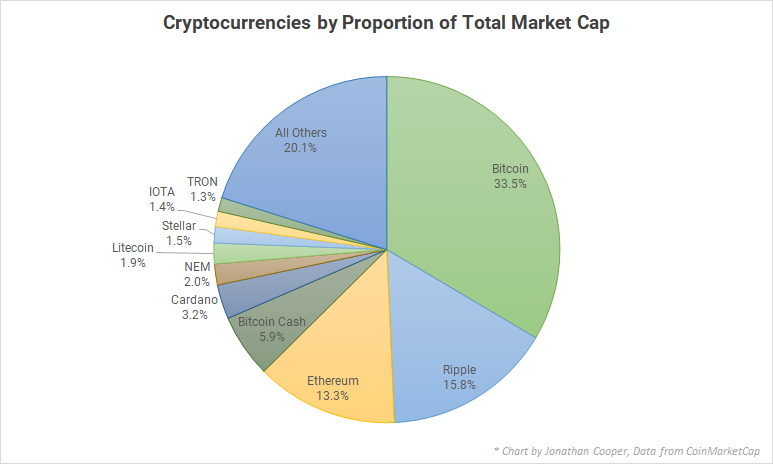

Cryptocurrency investors are constantly on the lookout for the next big crypto – the coin or token that will deliver exceptional returns. In mid-2025, the total cryptocurrency market cap surged to roughly $4 trillion, largely led by Bitcoin’s rally (Rodriguez Cruz & Chussler, 2025). This renewed enthusiasm has sparked questions like “which coin will be the next breakout star?” and “what factors define a potential blockbuster crypto?”. In this article we explore what makes a cryptocurrency promising, highlight top contenders and trends, and offer strategies for spotting that next big crypto.

What Defines “Next Big Crypto”?

The next big crypto typically has a combination of strong fundamentals, real-world use cases, and broad adoption potential. Industry analyses stress that successful tokens usually solve real problems or capture unique market niches. For example, WisdomTree notes that projects with innovative use cases (like decentralized finance or asset tokenization) tend to attract investor interest (Silenskyte, 2025). A crypto’s technology (speed, security, scalability) and community support are also critical: a chain with many active developers and users often has a better chance to shine.

Investopedia’s crypto guide emphasizes core evaluation criteria: market capitalization, liquidity (trading volume), supply dynamics, and use case. Monitoring these can help identify projects with growth potential (Amure, 2025). In particular, a low circulating supply relative to total supply can be a red flag (since future token unlocks could flood the market). Other key factors include the strength of a project’s team and partnerships. Seasoned analysts advise avoiding coins with no clear roadmap or that are riding a hype cycle without real purpose (Amure, 2025; Rodriguez Cruz & Chussler, 2025).

| Characteristic | What to look for |

|---|---|

| Real-world use case | The crypto solves an actual problem (e.g. smart contracts, DeFi, NFTs). |

| Scarcity and supply rules | Limited or fixed supply with clearly defined issuance schedule. |

| Decentralization | Large, distributed network of nodes (strong decentralization means no single point of failure). |

| Active community | Enthusiastic, growing user base (social media presence, developer activity). |

| Technical strength | Proven blockchain tech (fast, secure, upgradable, interoperable). |

Top Contenders and Emerging Altcoins

While the “next big crypto” could be a truly new project, the biggest current players often shape the landscape. For instance, Bitcoin and Ethereum remain market leaders, but their sheer size makes even modest percentage gains huge in dollar terms. Many investors therefore also eye promising altcoins (alternative cryptocurrencies).

Recent market analyses highlight some specific coins worth watching. Money.com identifies Chainlink (LINK), Hedera Hashgraph (HBAR), Sui (SUI), and others as high-potential projects. Chainlink, for example, dominates the market for decentralized data feeds and is migrating to Proof-of-Stake (Rodriguez Cruz & Chussler, 2025). Hedera offers a high-speed hashgraph ledger used by enterprises, making it a candidate for broader adoption. Sui, developed by former Facebook engineers, is a fast Layer-1 blockchain focused on consumer apps (Rodriguez Cruz & Chussler, 2025).

Other emerging trends point to where the next big crypto might arise. WisdomTree research suggests that stablecoins and DeFi applications will increasingly intermingle with networks like Solana and XRP in 2025. For example, Solana’s fast smart contract platform has attracted major stablecoins (USDC, USDT) to deploy on it, and XRP’s integration with payment platforms could drive value. Moreover, tokenization – the creation of token-based digital assets representing real-world value (like real estate or stocks) – is forecasted to be a game-changer. Cryptos enabling these innovations (such as security-token platforms) could emerge as major winners.

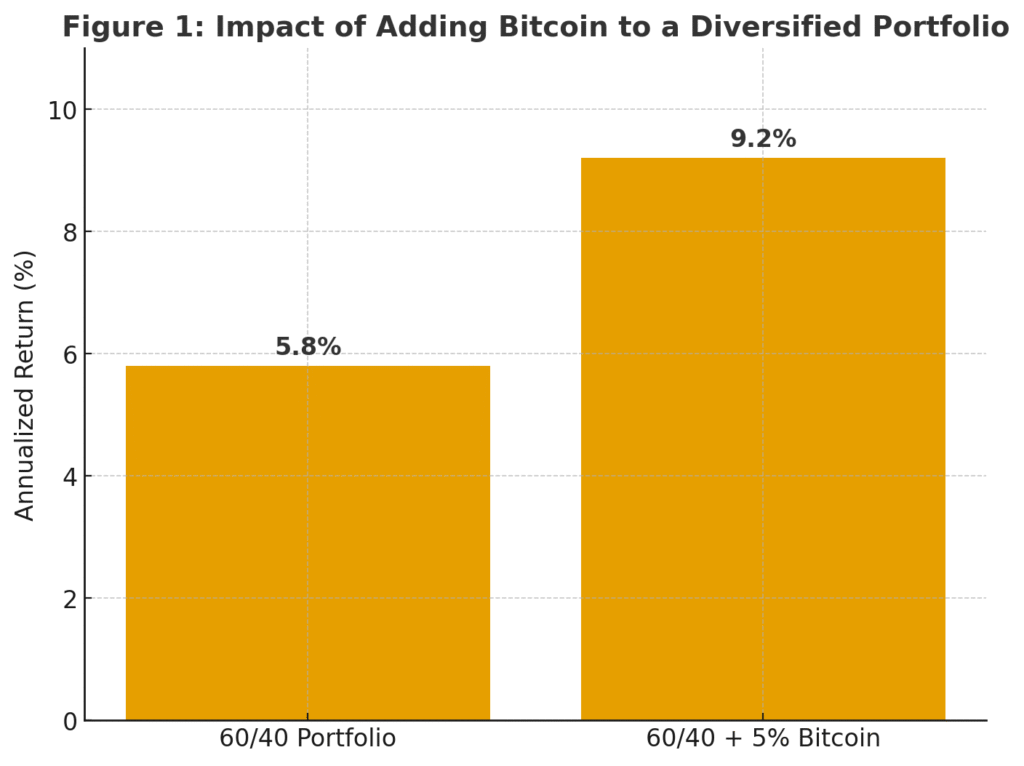

Figure 1: Even a small allocation to Bitcoin can significantly boost a diversified portfolio’s returns. WisdomTree (2025) shows that adding 5% Bitcoin to a 60/40 stock/bond portfolio raised annualized returns from ~5.8% to 9.2% Investors have seen that including top cryptos in portfolios yields outsized gains. According to WisdomTree, portfolios with a Bitcoin component tend to outperform similar portfolios without crypto. This trend is motivating more asset managers to seek the next big crypto, as exposure to any leading digital asset can enhance performance.

Strategies for Spotting New Crypto Opportunities

Given thousands of tokens, how does one pinpoint the next star? Experts and analysts suggest several approaches:

- Monitor Major Exchanges: New projects often appear first on large crypto exchanges (Coinbase, Binance, Kraken). If a reputable exchange lists a coin, it has passed basic scrutiny and gains visibility. Regularly checking listing announcements can flag promising tokens early.

- Use Data Aggregators: Tools like CoinMarketCap and CoinGecko provide charts of market cap, volume, and recent listings. These show which coins are surging or newly circulating. They also allow comparisons of metrics (e.g. one can see if circulating supply is much lower than max supply – a risky sign).

- Engage with Communities: Crypto thrives on community sentiment. Following forums and social media (Twitter/X, Reddit, Discord) can yield leads on hyped projects. However, beware of hype and misinformation: never buy just because a coin is trending in Twitter chats or meme groups. Always verify that the token has real functionality.

- Evaluate Technology and Team: A strong development team and codebase are crucial. Investigate whether the blockchain is open-source, how active development is, and who is backing it. Many failures come from anonymous teams or poorly written code (Amure, 2025). Also, check if the project’s roadmap is practical.

- Analyze Tokenomics: Consider supply and demand factors. A crypto with unlimited or inflationary supply may dilute gains. Tokens with fixed or very limited supply (like Bitcoin) can become more valuable as demand grows. Conversely, ensure a project isn’t issuing new tokens too quickly.

- Verify Legitimacy: New tokens should be scrutinized with tools. Use contract scanners (Token Sniffer, Honeypot Detector) to detect scams (Amure, 2025). Legit coins typically have transparent smart contracts and working demos. Legitimate projects are less likely to involve locked liquidity or hidden developer keys.

Risks and Caution

The pursuit of the next big crypto comes with risks. Crypto markets are highly volatile, and many new coins fade quickly or turn out to be scams. As Investopedia warns, speculation can cause even solid projects to underperform if overshadowed by viral meme coins. Always do thorough research: fundamentals first, hype second.

Regulation is another factor. Policy changes (like new crypto laws) can instantly affect prices. As an example, WiseTree notes that recent regulatory approval for Bitcoin and Ethereum ETFs has broadened crypto’s appeal. Future regulations could either boost (by adding legitimacy) or hinder certain crypto sectors.

Finally, timing matters. Market cycles shift – what boomed in 2021 (like certain DeFi tokens) may not soar again immediately. Some analysts believe that after a Bitcoin-led bull run, profits will rotate into select altcoins (InvestingHaven, 2025). Patience and a diversified approach (spreading risk across a few projects) often serve investors better than betting everything on a single newcomer.

Conclusion

Identifying the next big crypto requires blending optimism with caution. Seek coins with strong use cases, solid teams, active communities, and prudent tokenomics. Use reliable tools and expert insights to guide decisions. As of 2025, while Bitcoin and Ethereum dominate, emerging contenders like those highlighted above (e.g., Chainlink, Hedera, Sui) are on many watchlists (Rodriguez Cruz & Chussler, 2025; Silenskyte, 2025). Ultimately, the “next big crypto” will likely be one that combines innovation with real demand. By staying informed and vigilant, investors can better position themselves to spot these opportunities when they arise.

Also read: “The Best Crypto to Buy Now”

References

Rodriguez Cruz, G. O., & Chussler, J. (2025, August 7). Which Crypto Will Boom in 2025: The 8 Fastest-Growing and Trending Cryptocurrencies. Money. Retrieved from https://money.com/crypto-coins-growing/

ZebPay. (2025, August 25). Top 10 Cryptos to Invest In August 2025. ZebPay Blog. Retrieved from https://zebpay.com/crypto/

Silenskyte, D. (2025, January 13). Top 5 Crypto Trends to Watch in 2025. WisdomTree Prime. Retrieved from https://www.wisdomtreeprime.com/blog/top-5-crypto-trends-to-watch-in-2025/

Amure, T. O. (2025, May 28). How to Spot the Next Big Crypto: 5 Strategies for Identifying New Investment Opportunities. Investopedia. Retrieved from https://www.investopedia.com/how-to-spot-new-crypto-opprotunities-11712490

Pingback: Ripple Price Prediction 2025: Analyzing Future positive Trends of XRP - Crypto Idolo