Introduction

One of the first questions every crypto beginner asks is: when to buy Bitcoin? The price of Bitcoin has risen from less than a dollar to over $60,000 in just over a decade, and with such volatility it can feel intimidating to choose the right moment. The truth is that there is no single perfect entry point. Instead, beginners should focus on strategies that reduce risk, smooth out volatility, and encourage long-term thinking.

This guide will explain the main approaches to buying Bitcoin, the importance of long-term planning, and how you can start safely as a beginner.

Why People Ask “When to Buy Bitcoin”

Bitcoin is known for its extreme price swings. In 2017 it went from under $1,000 to nearly $20,000 before dropping back to $3,000. In 2021, it hit over $60,000, only to fall by half within months. Such dramatic cycles naturally make investors nervous about buying “too high” or missing opportunities.

New investors often fall into one of two traps:

- Waiting endlessly for the “perfect dip” and never buying.

- Jumping in during a hype cycle and panicking when prices fall.

The right mindset is to treat Bitcoin as a long-term investment and to use strategies that avoid relying on short-term predictions.

Market Cycles and Bitcoin’s Volatility

Bitcoin follows market cycles that typically include:

- Bull markets: long periods of rising prices.

- Corrections: sharp but temporary drops.

- Bear markets: prolonged declines.

For example, every four years Bitcoin experiences a halving, when the number of new coins created is cut in half. Historically, halvings have been followed by significant bull runs. However, no cycle is identical, and relying solely on events is risky.

Understanding that Bitcoin moves in cycles helps beginners accept that dips are normal and can even be opportunities on when to buy bitcoin.

Strategies for When to Buy Bitcoin

1. Dollar-Cost Averaging (DCA)

The most beginner-friendly strategy is dollar-cost averaging. This means investing a fixed amount of money at regular intervals (weekly, monthly) regardless of price.

Benefits of DCA:

- Removes the pressure of timing the market.

- Smooths out the effect of volatility.

- Helps avoid emotional decisions based on fear or hype.

For example, instead of buying €1,000 worth of Bitcoin at once, you might invest €100 every month for 10 months. This way, when the price is low you buy more, and when the price is high you buy less, averaging out your entry point.

2. Buying the Dip

Another approach is to buy when Bitcoin experiences a sharp drop. While this can maximize profits, it requires discipline and luck. Many beginners struggle because dips can quickly become deeper bear markets. If you choose this strategy, never invest money you cannot afford to lose.

3. Timing Around Halving Events

Halvings reduce the rate at which new Bitcoins enter circulation. Historically, the year following a halving has been bullish. Some investors choose to accumulate before and after these events. While it has worked in the past, it should not be your only strategy since markets may behave differently in the future.

Practical Steps for Beginners

- Set your goals: Decide if you want to hold Bitcoin for years, trade short-term, or diversify. For beginners, holding long-term is often best.

- Start small: Invest only what you can afford to lose. Even a small amount allows you to learn without major risk.

- Choose a reputable exchange: Platforms like Coinbase, Binance, Kraken, or regulated local exchanges are safest for beginners. Always enable two-factor authentication.

- Secure your coins: For long-term storage, transfer Bitcoin to a hardware wallet rather than leaving it on an exchange.

- Learn the tax rules: In many countries, selling Bitcoin creates taxable events. Research your local laws.

- Avoid scams: Never share your private keys and be cautious of offers promising guaranteed profits.

Risk Management Tips

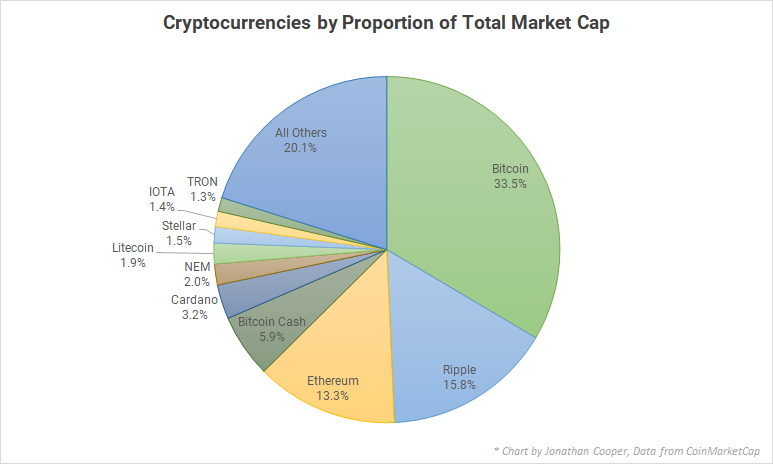

- Limit Bitcoin to a small portion of your overall portfolio (for example, 5–10%).

- Diversify with other assets like stocks or bonds.

- Accept volatility as normal and avoid panic selling.

- Stick to your plan and review it regularly instead of reacting emotionally.

FAQs About When to Buy Bitcoin

1. When is the best time to buy Bitcoin?

There is no guaranteed best time. For beginners, the safest method is dollar-cost averaging over months or years, rather than trying to guess short-term movements.

2. Should I wait for a dip before buying?

If you wait too long, you may miss gains. DCA ensures you benefit whether the price rises or falls, without the stress of waiting for the perfect dip.

3. How much Bitcoin should I buy?

Start small. Only invest what you can afford to lose. Many experts suggest allocating no more than 5–10% of your total investments to crypto.

4. Is it smart to buy Bitcoin before a halving?

Historically, halvings have been followed by price increases. However, this is not guaranteed. Consider it as one factor among many, not a sole reason to buy.

5. What if I buy and the price crashes?

Volatility is normal. If you plan to hold Bitcoin for several years, crashes may simply be part of the cycle. Avoid panic selling and stick to your long-term plan.

Conclusion

The question of when to buy Bitcoin has no simple answer. The market is too volatile and unpredictable for perfect timing. For beginners, the smartest path is to:

- Invest regularly through dollar-cost averaging.

- Limit exposure and manage risk carefully.

- Treat Bitcoin as a long-term investment, not a quick win.

By focusing on consistency and education, beginners can build a sustainable approach to Bitcoin without falling into the trap of chasing the perfect entry point.

Also learn more about XRP and their competitors: https://cryptoidolo.com/ripple-and-xrp-competitors/

References

Galaxy Asset Management. (2023). Time in the market vs. timing the market: Bitcoin investment strategies. Retrieved from https://www.galaxy.com

Investopedia. (2024). When to buy Bitcoin: Tips for beginners. Retrieved from https://www.investopedia.com

Kraken. (2024). What is Bitcoin halving?. Retrieved from https://www.kraken.com

Nakamoto, S. (2009). Bitcoin: A peer-to-peer electronic cash system. Retrieved from https://bitcoin.org/bitcoin.pdf

Securities and Exchange Commission (SEC). (2024). Investor alert: Bitcoin and crypto asset risks. Retrieved from https://www.sec.gov

Swedish Financial Supervisory Authority (Finansinspektionen). (2024). Risks with crypto assets. Retrieved from https://www.fi.se

European Securities and Markets Authority (ESMA). (2023). ESMA statement on crypto-asset investing. Retrieved from https://www.esma.europa.eu

Young Platform. (2024). Bitcoin halving explained. Retrieved from https://youngplatform.com

Pingback: BTC CoinGecko: Complete Guide to Tracking Bitcoin Price and Market Data - Crypto Idolo

Pingback: Ethereum Price Prediction 2025: Trends, Forecasts, and Analysis - Crypto Idolo